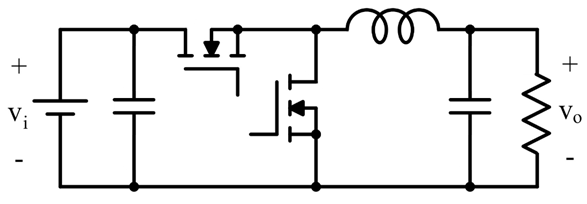

It really needs 5V to turn on well as can be seen from this datasheet graph:

#Fet calculator full#

The gate threshold voltage worst case is 3V, but that is not the voltage for full conduction, that is only to pass 1mA. 3.3v may not be enough to drive it enough into conduction for your needs. However, the 2N7000 is not the ideal device to drive from 3.3v. Provided the FET turns on well it won't affect the current through the LEDs or the LED resistor calculation significantly. You can drive the gate directly from the processor. If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29.99 for a one time purchase.You don't need any resistor at all at Rg.

#Fet calculator download#

You can get a free online reverse sales tax calculator for your website and you don't even have to download the reverse sales tax calculator - you can just copy and paste! The reverse sales tax calculator exactly as you see it above is 100% free for you to use. Add a Free Reverse Sales Tax Calculator Widget to Your Site! Let's be honest - sometimes the best reverse sales tax calculator is the one that is easy to use and doesn't require us to even know what the reverse sales tax formula is in the first place! But if you want to know the exact formula for calculating reverse sales tax then please check out the "Formula" box above.

Our widget is even customizable so that you can match the background and text colors to the layout of your website.

To use our “Reverse Sales Tax Calculator,” you can visit our website or put the calculator on your own website with our widget code. This is especially beneficial if you have to list your out-of-state purchases to you current state of residence and the taxes paid on those purchases. For some individuals, knowing how much sales they paid is essential for filling out correct tax returns and receiving monetary credit for overpaid sales tax. Most states and local governments collect sales tax on items that are sold in stores. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. Why A “Reverse Sales Tax Calculator” is UsefulĪ “Reverse Sales Tax Calculator” is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. The only thing to remember in our “Reverse Sales Tax Calculator” is that the top input box is for the sales tax percentage, and the bottom input box is for the total purchase price. From there, it is a simple subtraction problem to figure out that you paid. If your total receipt amount was $57.98, and you paid 1.07 percent in sales tax, you’d simply plug those numbers into our calculator to find out that your original price before tax was $57.37. All you have to input is the amount of sales tax you paid and the final price on your receipt. Our “Reverse Sales Tax Calculator” accepts two inputs. Have you ever wondered how much you paid for an item before the sales tax or if the sales tax on your receipt was correct? Now you can find out with our “Reverse Sales Tax Calculator.”

0 kommentar(er)

0 kommentar(er)